After more than 30 years defending consumers against debt collectors, I’ve heard every excuse, myth, and misconception imaginable. People cling to these beliefs because they feel safer than taking action. The problem is that these myths do not protect you. They delay the only steps that actually matter and often make the outcome far worse.

This article breaks down the seven most dangerous myths people rely on when they are sued for debt. Understanding why these ideas fail is the first step toward focusing on strategies that actually work in court.

Myth #1: “If I Ignore It, It Will Go Away”

The Myth People Believe

“I don’t have money for a lawyer, so there’s no point in responding. Maybe they’ll just give up and go away.”

This is the most destructive belief I see. People convince themselves that silence is a strategy, usually because they feel overwhelmed, ashamed, or financially trapped.

It is not a strategy. It is a surrender.

Why This Myth Is Deadly

Here is the reality most people never hear clearly enough: roughly 70% of consumers sued by debt collectors never file a response at all. When that happens, the collector does not need to prove anything. The court enters a default judgment automatically.

What typically follows when a lawsuit is ignored:

A default judgment entered within 30 to 60 days

Legal authority to garnish up to 25% of wages

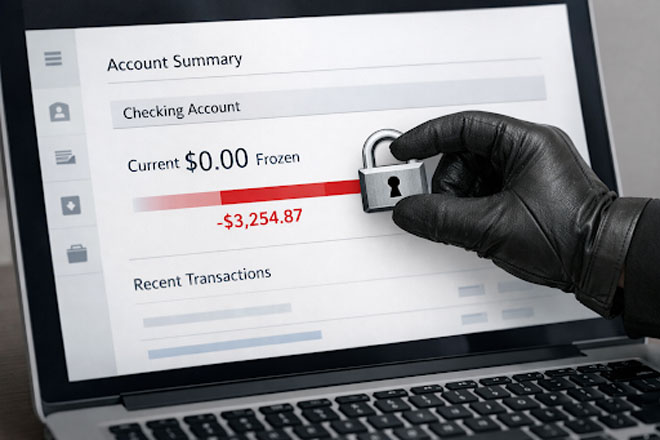

Bank accounts frozen and drained without advance notice

Property liens placed against real estate

Collection power that can last 10 to 20 years in many states

The timeline moves fast. Many people discover the judgment only when their paycheck is suddenly smaller or their debit card stops working because their account has been frozen.

The Reality Check

After reviewing thousands of cases through KillDebt, one pattern is consistent: most debt collection lawsuits contain serious legal weaknesses.

Common problems include:

Debt buyers who cannot prove they actually own the account

Missing contracts or incomplete account histories

Improper assignments and broken chains of title

FDCPA violations involving venue, statements, or service

Debts that are already outside the statute of limitations

The real tragedy is that many people lose cases they could have defended simply because they never responded. Ignoring the lawsuit does not make it disappear. It hands the win to the collector without a fight.

Myth #2: “Bankruptcy Will Automatically Stop Everything”

The Myth People Believe

“I’ll just file bankruptcy and all of this will stop.”

People often view bankruptcy as an emergency reset button. They assume it instantly freezes lawsuits, erases debt, and ends the stress without tradeoffs or timing consequences.

That belief is dangerously incomplete.

Why This Myth Fails You

Bankruptcy is not automatic protection and it is not consequence-free.

Common realities people learn too late:

Timing matters - If a judgment already exists, bankruptcy may not undo wage garnishments that have begun. Some garnished wages may already be gone, and recovering them is not guaranteed.

Asset exposure - Chapter 7 can require surrendering non-exempt assets. Home equity, investment accounts, vehicles, or business interests above exemption limits may be lost.

Long-term credit damage - Bankruptcy remains on your credit report for seven to ten years. That can affect housing applications, employment screening, insurance rates, and access to credit long after the lawsuit is gone.

Upfront cost barriers - Attorney fees commonly range from $1,500 to $4,000 plus court filing fees. Many people facing debt lawsuits do not have that cash available when they need it most.

Strategic loss - Filing bankruptcy can eliminate the ability to pursue FDCPA counterclaims that might otherwise result in damages, leverage, or dismissal of the lawsuit.

The Reality Check

Bankruptcy is a powerful tool when used at the right time. It is not a first move and it is not a substitute for defending a lawsuit.

In many cases, debt collection lawsuits can be dismissed, settled, or neutralized before bankruptcy ever becomes necessary.

The smarter sequence is simple:

Fight the lawsuit first. Preserve options. Consider bankruptcy only if judgments truly stack up.

Myth #3: “The Statute of Limitations Automatically Protects Me”

The Myth People Believe

“This debt is old. They can’t sue me anymore.”

People assume that once a debt passes the statute of limitations, courts will automatically block lawsuits or dismiss them on their own.

That is not how the system works.

Why This Myth Is Dangerous

Debt collectors can and do file lawsuits on time-barred debts every day.

Here’s the trap:

If you do not respond, the court never examines the age of the debt.

What actually happens:

Collectors file lawsuits on expired debts

Defendants fail to respond

Courts enter default judgments

The statute of limitations is never considered

A time-barred debt becomes legally collectible the moment a default judgment is entered.

The Legal Reality

Statute of limitations is not automatic protection. It is an affirmative defense.

That means:

You must raise it in your response

If you do not assert it, you waive it

Courts do not apply it for you

Collectors rely on silence to bypass it entirely

Additional complications:

Limitation periods vary by debt type

Credit cards, medical debts, and written contracts often have different time limits

The clock usually runs from the last payment or acknowledgment, not account opening

How Statute of Limitations Actually Works

To use this defense correctly:

Identify your state’s limitation period for the specific debt

Calculate from the correct triggering date

Assert the defense clearly in your response

Support it with documentation when possible

When properly raised, statute of limitations defenses are extremely effective. When ignored, they are worthless. Hope does not stop lawsuits. Responses do.

Myth #4: “Debt Buyers Don’t Have to Prove the Debt Is Valid”

The Myth People Believe

“Debt buyers already have everything they need. Challenging them is pointless.”

People assume that when a company sues, it must already possess airtight proof. That assumption is exactly what debt buyers rely on.

The Reality I’ve Documented

In practice, debt buyers rarely possess complete proof.

Debt buyers purchase massive portfolios for pennies on the dollar. What they receive is usually raw electronic data, not full legal files.

The problems appear immediately when cases are challenged.

Common documentation failures include:

Missing original contracts

Most debt buyers do not have your signed agreement or governing terms.Incomplete account histories

They rely on spreadsheets and summaries, not full monthly statements.Broken chain of title

Accounts pass through multiple entities without proper assignments.Authentication failures

Their witnesses often have no personal knowledge of your account or its history.

Why Default Judgments Matter to Debt Buyers

When you do not respond, none of these gaps matter.

They do not have to prove:

Ownership of the debt

Accuracy of the balance

Legal standing to sue

Compliance with evidentiary rules

Once a default judgment is entered, those weaknesses disappear.

When forced to litigate:

Many debt buyers dismiss rather than produce documents

Others settle quickly when discovery is requested

Some fail entirely when asked to authenticate their evidence

The leverage comes from forcing proof. Silence gives them a free win.

Myth #5: “FDCPA Violations Are Rare and Hard to Prove”

The Myth People Believe

“Big collection firms know the law. Violations are uncommon.”

People assume scale equals compliance. In reality, scale often creates repeatable mistakes.

The Reality of Systematic Violations

High volume debt collection produces repeatable errors. From reviewing real cases, FDCPA violations are not anomalies. They are patterns.

Common violations include:

Improper venue

Filing lawsuits in locations chosen for convenience, not legality.False ownership claims

Suing without proof of assignment or misstating who owns the debt.Improper service tactics

Using deception or unauthorized service methods.Mini-Miranda violations

Improper collection language inside legal pleadings under 15 U.S.C. § 1692e(11).Attorney certification defects

Attorneys signing documents under incorrect state authority.

Why FDCPA Violations Change the Case

FDCPA violations shift leverage immediately.

They can result in:

Statutory damages

Attorney fee exposure for the collector

Settlement pressure

Counterclaims that flip the posture of the case

Dismissal in severe circumstances

In one documented case, LVNV Funding dropped its lawsuit after ownership could not be proven. The consumer then pursued FDCPA claims against both LVNV and its servicer, turning defense into offense.

The real mistake is assuming violations are rare.

They are common. They just go unnoticed when no one responds.

Myth #6: “Securitization Arguments Don’t Work Anymore”

The Myth People Believe

“Courts have rejected securitization challenges, so there’s no point in arguing ownership.”

This belief usually comes from hearing about bad cases where defendants raised vague or copy-paste securitization arguments that courts quickly dismissed.

Why This Myth Is Misleading

Courts did not reject standing challenges.

They rejected lazy arguments.

Securitization itself is not the defense.

Ownership proof is.

When original creditors sell accounts into trusts or portfolios, ownership becomes layered, fragmented, and often poorly documented. Debt buyers frequently cannot show a clean transfer from the original creditor to the entity suing you.

That problem has not gone away. It has grown.

Common ownership failures still appearing in cases:

Broken chain of title

Multiple entities listed without complete assignments.Servicer confusion

Companies claiming ownership when they are only acting as servicers.Assignment timing defects

Transfers dated outside allowable windows or after trust closing dates.Generic bills of sale

Portfolio sales that never identify your specific account.

How Ownership Challenges Actually Work Today

Effective challenges do not argue theory. They demand proof.

Modern standing challenges focus on:

Requiring documented transfers from origination to present claimant

Forcing authentication of assignments and bills of sale

Exposing inconsistencies between pleadings and supporting exhibits

Demonstrating gaps that prevent the plaintiff from proving legal ownership

The difference is precision.

Courts reject generic securitization rhetoric.

They do not ignore missing ownership proof.

When ownership cannot be proven, cases stall, settle, or collapse.

Myth #7: “I’ll Wait Until They Garnish My Wages to Deal With It”

The Myth People Believe

“I’ll deal with this later. If it gets serious, then I’ll act.”

People assume they can respond after judgment when the problem feels more urgent. That delay is exactly what debt collectors expect.

Why Waiting Is So Costly

Everything changes after judgment.

Before judgment:

The collector must prove standing, amount, and compliance

You can force discovery and expose weaknesses

Settlement leverage exists because litigation costs remain

Counterclaims are available

After judgment:

Collection authority is automatic

Burden shifts to you

Garnishment and seizures can begin quickly

Interest accrues

Leverage disappears

Wage garnishment often starts within weeks. Bank accounts can be frozen without warning.

By the time people react, they are already defending against enforcement instead of attacking the lawsuit.

The Strategic Timeline Reality

The lawsuit phase is where outcomes are decided.

During that window:

Standing challenges can end cases entirely

Documentation defects create settlement pressure

FDCPA violations can flip the posture of the case

You control timing and strategy

Post-judgment options still exist, but they are:

Narrower

More expensive

More time-sensitive

Less likely to succeed

The Math never favors waiting.

Preventing judgment is cheaper, faster, and far more effective than trying to undo one later.

The Real Strategies That Actually Work

What Actually Stops Debt Collectors

After more than 30 years defending consumers, the pattern is clear. Debt collectors don’t lose because people are clever. They lose because the law forces proof and most cases cannot survive that pressure.

These are the strategies that consistently change outcomes:

Comprehensive Legal Response: Filing a proper answer forces the collector to prove standing, ownership, amount accuracy, and legal compliance. Default judgments only happen when no response is filed.

Standing and Ownership Challenges: Debt buyers must prove they own the specific account they are suing on. Broken chains of title, missing assignments, and servicer confusion are common and often fatal when challenged.

Aggressive Discovery: When forced to produce original contracts, complete account histories, and authenticated assignments, many collectors cannot comply. Discovery exposes weaknesses that are invisible on the complaint.

FDCPA Counterclaims: Improper venue, false representations, deceptive service, and misstatements of ownership create leverage. Violations can shift the case from defense to offense.

Statute of Limitations Defense: When properly asserted as an affirmative defense, time barred debts can end cases entirely. The protection exists only if raised correctly and on time.

None of these strategies work if the lawsuit is ignored. Every one of them requires an active response.

A Systematic Defense Beats Guesswork

Most people fail not because defenses don’t exist, but because they don’t know where to look or how to apply them.

KillDebt was built to close that gap.

At the center of the system is ParkerGPT, which analyzes lawsuit documents the way a defense attorney would. It identifies where the collector’s case breaks down and shows which strategies actually apply to that specific lawsuit.

ParkerGPT is used to:

Identify standing and ownership defects

Flag FDCPA violations hidden in pleadings and service

Surface documentation gaps collectors hope go unchallenged

Guide discovery and response strategy based on the case posture

Create leverage before a judgment is entered

In cases like the Carlos Bernol lawsuit in Virginia, proper defense exposed ownership failures, forced dismissal, and opened the door to FDCPA claims. The outcome changed because the case was challenged, not ignored.

Your Action Plan: Focus on What Works

Stop Relying on Myths

Do not ignore the lawsuit

Do not assume age of debt protects you automatically

Do not wait for garnishment to start

Do not assume collectors follow the law without pressure

Apply Proven Strategies

File a timely, comprehensive response

Challenge standing and ownership

Use discovery to force proof

Identify FDCPA violations early

Assert statute of limitations properly when applicable

Be Systematic, Not Reactive

Analyze the complaint and attachments for gaps

Use weaknesses to create settlement leverage

Preserve counterclaims instead of waiving them

Control the timeline instead of responding to enforcement

Debt collectors win by volume and silence. They lose when cases are forced to stand on evidence.

Why People Cling to Myths Instead of Taking Action

The Psychology of False Comfort

When people are sued, myths feel safer than reality. They reduce anxiety in the short term by promising relief without confrontation.

The most common psychological traps I see are:

Denial: "This isn't really happening to me"

Magical thinking: "Someone else will fix this"

Learned helplessness: "I can't afford to fight, so why try?"

Procrastination: "I'll deal with this later when I have more resources"

The Real Cost of Myth-Based Decisions

Every day spent relying on myths instead of action quietly reduces your options and increases the damage. These consequences compound fast, and most people do not realize what they are losing until it is already gone.

In practical terms, that loss shows up in predictable ways:

Response deadlines move closer with no warning from the court

Evidence that could support defenses becomes harder to gather

Settlement leverage declines as collectors invest more into the case

Asset protection options narrow once judgment becomes likely

Breaking the Pattern

Escaping these traps requires replacing false comfort with accurate expectations and understanding that action is not about confidence, but about preserving leverage before it disappears.

In practice, that means recognizing the following realities:

Lawsuits require a response to preserve any rights

Debt collectors often cannot prove ownership or amounts when challenged

FDCPA violations are common and actionable

Structured help exist at a fraction of the cost of default judgment

The Economic Reality of Myths vs. Action

What Myths Actually Cost

Default judgment is not neutral. It is expensive, permanent, and one sided.

Typical consequences include:

A $5,000 judgment growing to $15,000 or more through interest and enforcement

Wage garnishment of $200 per month becoming $2,400 per year indefinitely

Bank account seizures draining balances instantly and triggering secondary losses

Credit damage lasting seven years or longer, affecting housing and employment

The Cost of Real Defense

Defending a lawsuit is not free, but it is controllable:

KillDebt + ParkerGPT: $149/month with systematic defense generation

Traditional attorney representation: $3,000-8,000 but may be unnecessary for most cases

Self representation with Consultation support: Typically $300–$3,000 in limited consultations

Time investment: 20-40 hours over 3-6 months for self-representation with proper guidance

Return on investment: Preventing a $5,000 judgment through proper defense saves $10,000-20,000 in long-term costs while preserving credit and financial stability.

The Outcome Math

When compared directly:

Myth based strategies almost always end in default judgment

Proper legal response regularly leads to dismissal, settlement, or leverage

Even partial success dramatically outperforms silence

The conclusion is not philosophical. It is mathematical.

Believing myths guarantees loss. Taking action preserves options.

Next Steps in Your Debt Defense Journey

Understanding what won't save you is crucial, but taking effective action protects your financial future. Your next learning priority should focus on:

What to Do When Sued by a Debt Collector: Complete First Steps Guide - Immediate action plan using strategies that actually work instead of myths that fail

How to File an Answer to a Debt Collection Lawsuit: Step-by-Step Guide - Comprehensive response templates based on 30+ years of successful defense strategies (Coming Soon)

FDCPA Rights: What Debt Collectors Cannot Do to You - Federal protections that create real counterclaim opportunities rather than false hope (Coming Soon)

Related Defense Strategies

Understanding Your Debt Collection Lawsuit Papers: Summons vs. Complaint - Document analysis skills that reveal the weaknesses myths can't address

Default Judgment Explained: Why 70% of People Lose Without Fighting - Understanding why myth-based inaction leads to automatic loss (Coming Soon)

Affirmative Defenses in Debt Cases: 15+ Defenses That Work - Legal strategies with documented success rates versus myths with 100% failure rates (Coming Soon)

Counter-Affidavit Strategy: Turning Defense into Offense - Advanced techniques that create offensive opportunities beyond myth-based hope (Coming Soon)

About Brian Parker

I have over 30 years of experience defending consumers against debt collection lawsuits and have developed comprehensive strategies that protect assets by preventing the judgments that create garnishment authority. Through KillDebt.com, I've systematized these proven defense strategies to help more consumers understand their rights and take proactive action before facing wage garnishment, bank account seizure, and asset hearings. My approach recognizes that the best asset protection comes from aggressive legal defense that prevents judgments, rather than reactive measures after collection authority is established.

Frequently Asked Questions (FAQ)

Can a debt collector really win if they have no proof?

Yes, if you do not respond. Courts do not examine evidence in default cases. A collector with weak or nonexistent proof can still obtain a judgment if no answer is filed.

Do courts automatically protect me if the debt is past the statute of limitations?

No. Statute of limitations is an affirmative defense. If you do not raise it in your response, it is waived and the court will not apply it for you.

Is ignoring the lawsuit worse than negotiating later?

Yes. Once judgment is entered, leverage disappears. Settlement after judgment is almost always more expensive and comes with active enforcement like garnishment and bank seizure.

Do debt buyers usually have complete documentation?

Often they do not. Many cases rely on electronic data, incomplete records, and generic bills of sale. These weaknesses only matter if the case is challenged.

Are FDCPA violations actually useful in a lawsuit?

Yes. Violations can create counterclaims, settlement pressure, and attorney fee exposure. They frequently change the posture of the case when identified early.

Is it ever too late to respond?

After judgment, options still exist, but they are narrower, more expensive, and harder to win. The most effective window is before judgment, during the lawsuit phase.

IMPORTANT LEGAL DISCLAIMER

This educational content is based on general legal principles and extensive debt collection defense experience. This information is provided for educational purposes only and does not constitute legal advice for any specific situation.

Critical Multi-State Variations:

Wage garnishment protections: Range from no garnishment (Texas, North Carolina) to federal minimums only (Michigan, Florida)

Bank account exemptions: Vary dramatically from $200 (some states) to $5,000+ (Wisconsin) beyond federal benefits, with different claim procedures

Homestead exemptions: Range from $0-$30,000 to unlimited protection depending on state

Asset hearing procedures: Frequency, scope, and debtor protections vary significantly by jurisdiction

Personal property exemptions: Vehicle, household goods, and tools of trade protections differ substantially

Judgment collection periods: Range from 5-20 years with varying renewal procedures

Perjury enforcement: Standards and penalties for incomplete asset disclosure vary substantially between jurisdictions

State-Specific Legal Requirements:

Asset protection laws, exemption procedures, and garnishment rules vary significantly by state and local jurisdiction

Specific exemption claim procedures and deadlines differ substantially between jurisdictions

Some states provide extensive debtor protections while others offer minimal protection beyond federal requirements

Individual circumstances may require different asset protection strategies than those described

Professional Legal Advice Required: This content cannot replace personalized legal advice from a qualified attorney licensed in your jurisdiction. Before implementing asset protection strategies or facing collection activities, consult with a debt defense attorney familiar with the specific exemption laws and procedures in your state.

No Attorney-Client Relationship: Reading this content does not create an attorney-client relationship. For specific legal advice about protecting your assets from debt collection, co